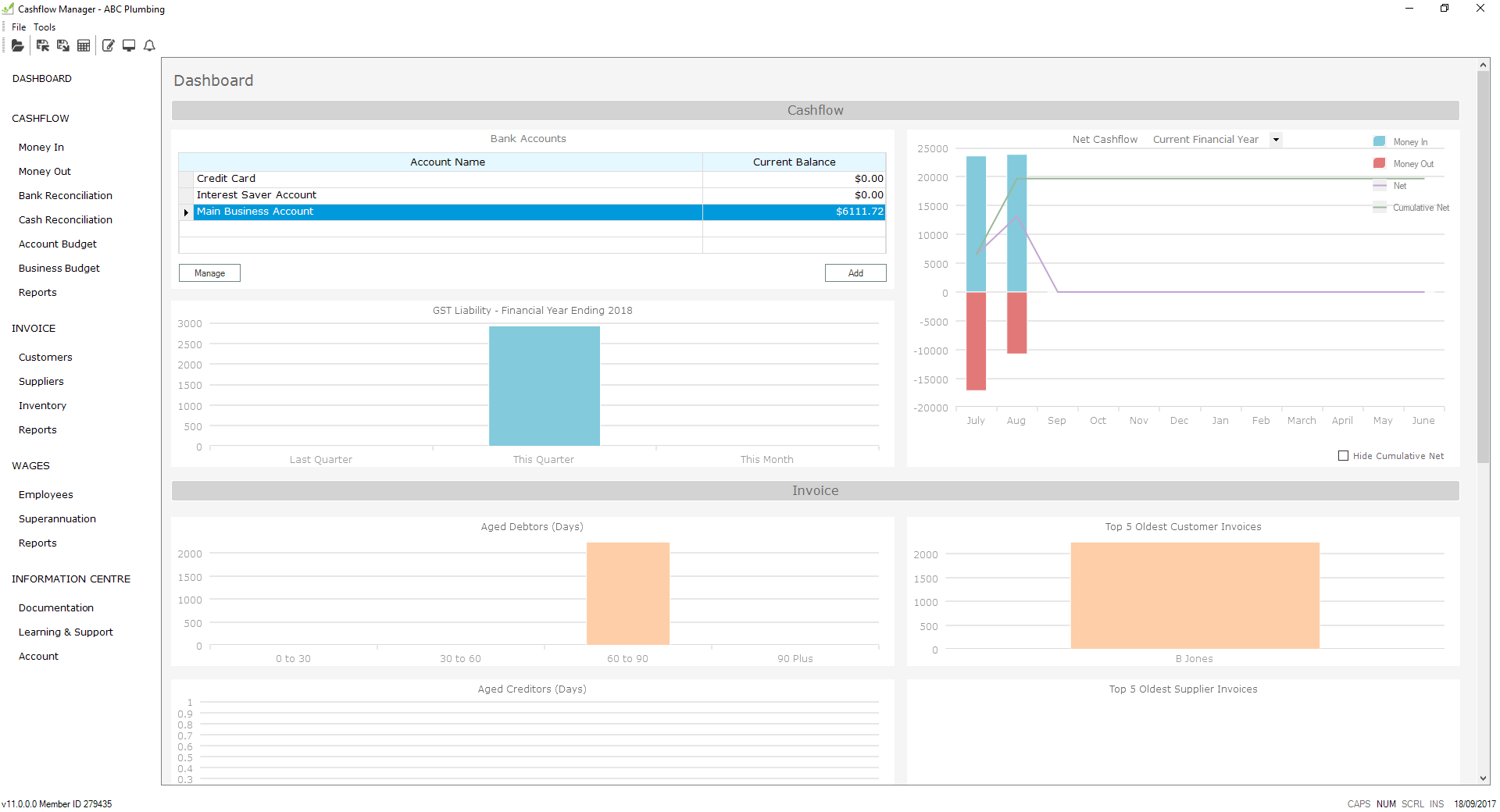

It is used to show the critical performance metrics that describe a business’s profitability and financial health. Profit and Loss dashboardĪ P&L dashboard, also known as a financial dashboard, summarizes expenses, revenues, and the costs acquired throughout a fiscal year. Financial institutions such as banks and venture capital firms use this dashboard to show AUM( Assets Under Management) balance by investment type and business unit. A CAGR dashboard can be used to demonstrate the time value of the money function of the underlying finance analytics platform. CAGR dashboardĬAGR is the growth rate that gets you from the initial value to the ending investment value assuming that the investment has been compounding over time. The gross profit can be used to determine the value of every sale and help make decisions regarding pricing and promotions. This doesn’t include indirect costs such as marketing. The gross profit (margin) is the money you make directly from selling goods and services, minus the sale cost. The cash conversion cycle formula is:Ĭash conversion = days inventory outstanding + days receivable outstanding-days payable outstanding A lower cash conversion cycle means that you have more cash on hand to generate returns and reduce your line of credit. You can quickly tell if you have enough cash on hand to meet short-term needs by analyzing your quick ratio and working capital ratio.īy tracking this metric, a business can identify the source of its cash flow problems. A rule of thumb is to continuously monitor the cash you have on hand, checking it against the target you set when you made your financial projection. An effective cash flow dashboard includes the following essential metrics:Ĭash on hand is usually monitored so that if it falls below target, the company can take some contingency measures. Cash Flow dashboardĪ cash flow dashboard displays real-time data helping you monitor your business’s cash flow to help you assess and improve its financial health. This allows analysts to improve profitability and reduce costs. Modern dashboards leverage finance analytics platforms to synthesize disparate financial and accounting data. Many professionals are used to using BI tools to visualize their data. By creating a financial dashboard, finance professionals can visualize their numbers in a meaningful way to understand the numbers. All you need is to enter initial data in an excel template, and the tool is ready to use.Financial dashboards help finance professionals track and analyze the financial performance of their organization and ease tasks related to financial reporting. FinmodelsLab created a pretty smooth cash flow excel dashboard, which helps business owners analyze the structure and movement of your money during the year.

Usually, creating cash flow statements required financial education and proper analytical skills. It determines the liquidity of the firm and its' capacity to pay bills. That's why the understanding of how much money comes in and how much it comes out is so crucial. The successful operation of every business depends on how much cash you have. Enter your information, and the template calculates the rest- so you'll remain focused on your business and future opportunities. And, the recognizable Excel spreadsheet format makes this layout as easy to utilize because it is lovely. The Cash Management Dashboard lets you rapidly determine areas where your company is exceeding expectations and those that require immediate touch. Reviewing a year at a time, so you'll be able to spot patterns and compare together with your current assets. With this template, you can visually track month-over-month cash flow stream details with this handy Dashboard. The Cash Flow Dashboard Template helps you focus on how your business burns cash and seven core metrics.

0 kommentar(er)

0 kommentar(er)